Rugby is a fast-paced and physically demanding sport, making Rugby Sport Insurance essential for amateur youth leagues, teams, and event organizers. Whether you’re managing a local club or hosting a tournament, having the right coverage ensures players, coaches, and volunteers are protected from unexpected risks.

At Westpoint Insurance, we offer specialized Rugby Sport Liability Insurance designed to safeguard organizations against claims related to injuries, property damage, and medical expenses. With the physical nature of rugby, accidents can happen, and our policies provide financial protection and peace of mind for teams and event organizers.

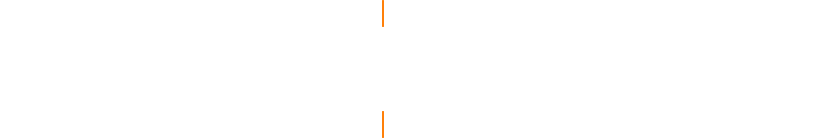

Planning a youth rugby tournament? Our Rugby Event Insurance covers everything from venue liability to participant injuries, ensuring smooth operations and risk management throughout your event. We work closely with teams, leagues, and schools to customize coverage that meets your specific needs while complying with governing body requirements.

Don’t leave your rugby club or event vulnerable to costly liability claims. With Rugby Sport Insurance from Westpoint Insurance, you can focus on player development and game day excitement, knowing your organization is fully protected. Contact us today for a customized quote and secure your team’s future on and off the field.

Rugby Sport Insurance | Rugby Sport Liability Insurance | Rugby Event Insurance

General Liability Insurance Plan

Protects you in the event of a lawsuit or property damage

Mandatory Accident Medical Plan

Pays the medical bills of an injured participant or staff member.

Disclaimer: All of the above exclusions and limitations are subject to the terms and conditions of the insurance policy. Certain of these exclusions or limitations may be modified to meet individual state requirements. Premium rates are subject to change. The rates in the quotation are based on information provided by the risk at the time of application and may be modified if the information changes from the initial submission by the risk. This description highlights the benefits, exclusions & limitations of the program, but is not a contract. For specific contract details, please request and review the insurance policy.